Editor’s Picks: Gold Price Breaks Through US$2,400, What’s Going On?

It was another record-breaking week for gold, which surged past US$2,400 per ounce for the first time ever. Copper prices also kept rising, while Gina Rinehart’s Hancock Prospecting took a stake in US rare earths producer MP Materials. This video…

John Ciampaglia: Copper Emerging from Slumber, is it the Next Uranium?

John Ciampaglia of Sprott Asset Management shares his thoughts on copper, going over supply and demand dynamics, as well as what’s behind the metal’s recent price breakout and how high it could go in 2024. He also discusses the recent…

Thom Calandra: Gold’s “Stealth Rally” Already Starting to Move Stocks

Thom Calandra of the Calandra Report shares his thoughts on the resource sector, focusing on gold, as well as uranium’s big price run and copper’s potential. He also shares strategies for silver and platinum, along with commentary on lithium, cobalt…

Peter Grandich: Gold, Uranium, Copper — Outlook and Strategies for 2024

@Peter-Grandich of Peter Grandich & Co. shares his thoughts on gold and uranium in 2024, and also speaks about the health of the junior resource sector. “I think all the undercurrents that you would want for gold to continue going…

Chris Temple: Gold Takeoff Brewing, but Uranium’s Setup Still the Best

Chris Temple of the National Investor believes gold has limited downside, with various factors lining up to push the yellow metal higher. However, even after 2023’s massive price increase, he believes uranium is the market with the most upside right…

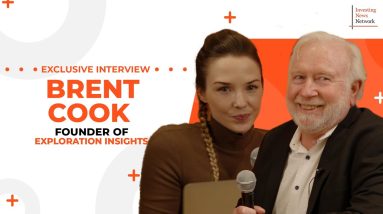

Brent Cook: 2024 Looks Better for Gold, but Here’s What’s Working Now

Brent Cook of @ExplorationInsights thinks 2024 will be a better year for gold, but what stocks are working in the meantime? “Drill results still work,” he said at the New Orleans Investment Conference. “But what’s surprising, and what I think…

Teo Dechev: Copper Demand Rising, Search for New Deposits Going Strong

Copper is a key part of the energy transition, but as demand increases and large mines reach the end of their lives, questions are being raised about where future supply will come from. Teo Dechev, CEO, president and director of…