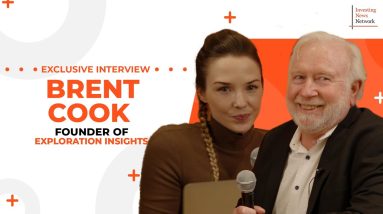

Brent Cook: 2024 Looks Better for Gold, but Here’s What’s Working Now

Brent Cook of @ExplorationInsights thinks 2024 will be a better year for gold, but what stocks are working in the meantime? “Drill results still work,” he said at the New Orleans Investment Conference. “But what’s surprising, and what I think…

Jeff Clark: Juniors “Dramatically Oversold,” is This a 100 Year Opportunity?

Jeff Clark of TheGoldAdvisor.com shares his thoughts on sentiment in the junior resource sector, saying that while many of these stocks are oversold right now, a 100 year opportunity could be shaping up for investors. “These things cycle — we’ve…

Gwen Preston: Uranium Looks Best Right Now, but Bullish Gold Drivers Stacking Up

Gwen Preston of @TheResourceMaven shared her thoughts on sentiment in the junior resource sector, saying that while the majority of investors in the space are “despondent,” there’s an incredibly excited minority that are looking for opportunities. “The way I look…

Brien Lundin: Mining Stocks at Turning Point, Biggest Opportunity Since 1999

Ahead of the New Orleans Investment Conference, which is scheduled to run from November 1 to 4, Brien Lundin of Gold Newsletter discusses sentiment in the gold sector and factors driving the precious metal. Speaking about the ongoing Israel-Hamas war,…

John Feneck: Gold Due for Sector Rotation, 10+ Stocks to Watch Now

John Feneck of Feneck Consulting shares takeaways from the Precious Metals Summit and Denver Gold Forum, and speaks about his recent visit to Ascendant Resources’ Lagoa Salgada project in Portugal. He also shares updates on 10 other stocks focused on…

#investingtips: Why a company’s management team is important

Private investor Don Hansen shares why management is important when evaluating mining companies. #investing #stockmarket #mining ________________________________________________________________ Investing News Network (INN) Find out more about investing by INN @ https://investingnews.com/ Browse our 2023 outlook reports: http://bit.ly/3JHyR1M Follow us Facebook: https://www.facebook.com/investing.news.your.trusted.source…

Investor Education: Gold and Silver Stock Evaluation with Expert Don Hansen

Private investor Don Hansen, who has honed his due diligence process over more than 20 years of investing in the resource sector, breaks down how he evaluates gold and silver producers, developers and explorers. Don’s first INN interview: https://www.youtube.com/watch?v=jkJHz0JSXlo&t=0s Don’s…

John Feneck: Gold Price and Equities Not in Sync, How to Play “Huge Disconnect”

This interview was filmed on April 6, 2022. The gold price has pulled back since the highs seen earlier this year, but it remains elevated as factors like the Russia/Ukraine war and inflation continue to provide support. The same can’t…